Real Estate Capital Investments: A Guide to Structure Steady Earnings

Realty capital financial investments have long been a favored for financiers looking for constant earnings streams while developing wealth. Unlike conventional supply or bond financial investments, realty supplies tangible, income-producing residential or commercial properties that can give regular monthly or quarterly returns. If you're aiming to begin or boost your profile in property cash flow investments, this overview covers the essentials, types of cash flow homes, and techniques to maximize returns.

What Are Property Cash Flow Investments?

Cash flow in property refers to the earnings a residential or commercial property produces after representing expenditures like mortgage settlements, property taxes, insurance policy, and maintenance prices. Favorable capital financial investments happen when rental earnings surpasses costs, leaving investors with earnings. Lots of view property cash flow as a secure and predictable method to gain revenue, whether with domestic rental properties, business buildings, or other types of income-generating realty.

Why Think About Property Capital Investments?

Steady Revenue Stream

Cash flow financial investments give regular income, which can be reinvested, used for expenses, or saved. Unlike stocks, which depend heavily on market conditions, rental revenue tends to stay more steady, making it excellent for risk-averse capitalists.

Tax Benefits

Investors can benefit from tax obligation deductions, such as depreciation, mortgage interest, and property-related expenses, which can decrease taxable income.

Gratitude Potential

Gradually, property values tend to value. This twin advantage of recognition and cash flow can create a robust financial investment possibility that develops riches over the long term.

Control and Tangibility

With real estate, you have control over building monitoring decisions, renter selection, and renovation alternatives, offering more control over capital than standard investments.

Types of Property Capital Investments

Single-Family Leasings (SFRs).

These are standalone homes rented to people or households. SFRs are commonly much easier to manage, extra affordable for newbie investors, and often tend to draw in longer-term tenants, minimizing turnover prices and vacancy prices.

Multi-Family Residences.

Multi-family residential or commercial properties consist of duplexes, triplexes, and apartment. These properties use the advantage of several income streams from a single property, which can improve capital capacity and minimize vacancy dangers.

Business Realty.

This consists of office buildings, retail rooms, and commercial properties. Industrial leases are usually long-lasting, providing steady revenue and generally moving some upkeep costs to renters, which can improve capital margins.

Trip Rentals.

Temporary leasings like villa or Airbnbs can give considerable income, especially in high-demand places. Although they might require a lot more energetic monitoring, the potential capital can be high, specifically in popular visitor destinations.

Mixed-Use Feature.

Mixed-use residential or commercial properties integrate domestic, business, and often also retail spaces. These residential or commercial properties take advantage of diverse earnings streams and can prosper in locations with high foot website traffic or city allure.

Trick Strategies to Make The Most Of Cash Flow.

Location is Key.

The home's place is one of the most essential determinants of rental demand and property recognition. Focus on places with low vacancy prices, high rental need, and future development capacity.

Effective Residential Or Commercial Property Management.

Managing expenditures and making best use of rental revenue can make a considerable difference. Employing a reliable property supervisor, remaining on top of repair work, Real estate cash flow investments and setting affordable leas can improve cash flow.

Routinely Testimonial Rental Prices.

Guaranteeing rents go to or slightly over market degrees assists maximize revenue while keeping tenants pleased. Carrying out periodic rental fee evaluations and comparing with regional market rates guarantees you're not leaving money on the table.

Maximize Funding Terms.

Financing terms can impact capital considerably. As an example, picking a car loan with a lower rates of interest or a longer amortization period can reduce monthly repayments, improving net capital.

Lessen Vacancies.

Keeping turn over rates reduced helps preserve consistent cash flow. Dealing with tenants well, using incentives for renewals, and making certain smooth property administration can reduce job rates and turnover costs.

Think About Value-Add Investments.

Sometimes small renovations, like upgrading kitchen areas or shower rooms, can enable you to charge greater rental fees and raise renter fulfillment. These value-add improvements can result in higher cash flow with reasonably reduced in advance expenses.

Just How to Compute Capital in Real Estate.

Before investing, it's important to understand exactly how to compute cash flow:.

Gross Rental Revenue.

This is the total revenue the residential property creates from lease and any extra fees (e.g., family pet fees, auto parking).

Operating Costs.

Includes all regular monthly costs connected to the residential property, such as property taxes, insurance policy, upkeep, management fees, energies, and repair services.

Financial obligation Service.

The month-to-month home loan repayment, which includes principal and passion.

Web Operating Revenue ( BRAIN).

Subtract overhead from the gross rental earnings. This figure represents income before financial obligation solution.

Cash Flow.

Finally, subtract the financial debt solution from the NOI. If this number is positive, the home has a favorable capital, which means it's creating revenue.

Instance Computation:.

Gross Rental Revenue: $2,500/ month.

Operating Expenditures: $500/month.

Financial obligation Solution: $1,200/ month.

BRAIN = $2,500 - $500 = $2,000.

Cash Flow = $2,000 - $1,200 = $800.

In this instance, the investor would certainly make a monthly cash flow of $800.

Dangers in Real Estate Capital Investments.

While real estate cash flow financial investments can be profitable, they feature some dangers:.

Job Danger.

Extended openings can injure cash flow, especially in locations with high tenant turnover or seasonal demand. Properly assessing rental demand can reduce job dangers.

Maintenance Expenses.

Unexpected fixings or high upkeep costs can eat into profits. Constructing a upkeep get and preparation for routine fixings is important for long-term sustainability.

Market Fluctuations.

Realty markets can be intermittent, and property values might fluctuate. While capital can continue to be constant, recessions out there might affect recognition possibility.

Tenant-Related Problems.

Handling hard tenants, late payments, or residential property damages can strain capital. Correct occupant testing and normal residential property checks can help reduce these dangers.

Tips for Starting in Property Cash Flow Investments.

Begin Small.

Novices might locate single-family services much more convenient and economical. Beginning small enables you to get experience without frustrating economic commitments.

Collaborate with Experts.

Consult with realty specialists, including real estate agents, building supervisors, and financial advisors, who can supply valuable insights and help you make informed decisions.

Enlighten Yourself.

Find out about real estate fundamentals, tax benefits, and local markets. Attending workshops, signing up with property financial investment teams, and checking out respectable sources can be useful.

Be Patient.

Building a cash money flow-positive realty portfolio takes time. Remaining regular, gaining from experiences, and reinvesting revenues can yield significant returns over the long-term.

Realty cash flow investments supply an efficient way to generate constant earnings while building https://sites.google.com/view/real-estate-develop-investment/ long-term wide range. By choosing the right property kind, optimizing cash flow strategies, and meticulously determining possible returns, you can produce a lucrative profile that satisfies your financial objectives. Whether you're interested in single-family services or industrial properties, property cash flow investing can be a trusted possession for creating monetary security and easy income.

Luke Perry Then & Now!

Luke Perry Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Devin Ratray Then & Now!

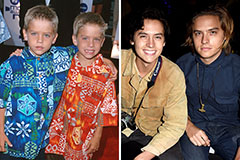

Devin Ratray Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now!